Automate and Chill: Your Guide to Becoming a Financial Automaton

What is an automaton? Specifically, what is a financial automaton? You quietly ask yourself if you should consult the Googler but fret not- I am here to explain.

An automaton, a word often used in similes and comparisons, refers to a person who seems to act in a mechanical or unemotional way. Add finances to the mix, and basically, I am suggesting that you should strive to become a robot in (some) money areas. Why operate as an automaton/robot? Because they do what they are pre-programmed to do with no hesitation. If you are able to successfully automate your income, then you will experience what it feels like to make moves for your future without unnecessary stress or extra time taken away from your already full day.

Here are some simple steps that you can do to streamline your cash flow:

- Set up Direct Deposit through your job (if possible). Not only will you be saving time, but you’ll often receive your paycheck as early as 12am on Fridays. Party!

- Register for Bill Pay and Paperless Billing. You will literally be saving the planet while simultaneously ridding yourself of late fees, interest charges, and, possibly, overdraft fees.

- Pay Yourself First. You can start saving at any salary. So, start socking away a certain amount each week or month to meet your financial goals. You can even allocate a part of your check to go directly into a savings account when you sign up for direct deposit. Boom!

- Join your company’s 401k or retirement savings, especially if the company offers to match your contribution. It is literally like being paid to save!! Why not?!

- Set up a special savings account for specific, large future financial goals. Don’t forget to put money aside for the big, important, and dare I say it, fun things you want out of life. Treat yourself by putting a percentage of your check towards saving for that down payment, your dream vacation, your new car, or the wedding that you’ve always wanted.

- Funnel money to an emergency fund. Rainy days happen sooner or later. So much like you keep an umbrella on hand in the event of rain, so should you sock aside some dough for unexpected costs.

- Give and give regularly. In giving to organizations that you believe in, you are refocusing your attention on what matters to you and making a difference in the world. A total win-win.

You do not rise to the level of your goals. You fall to the level of your systems.

James Clear, Author of Atomic Habits

At AmPopsy, we tend to be voracious readers who crave information just as much as we crave cupcakes and great clothes. So, I will leave you with two great books that can help you step up your financial automation skills. After all, “You do not rise to the level of your goals. You fall to the level of your systems.” This is the main theme of the first amazing book to check out if you are serious about taking it to the next level of financial automation. The book is called Atomic Habits by James Clear. Habits, Mr. Clear says, are “the compound interest of self-improvement.” The phrase “atomic habits” refers to the hundreds of votes you cast throughout the day about who you’ll be in the future. The more your life runs on daily habits, the more freedom you’ll have to focus on more important work. An easy read with understandable and doable action items.

The second book recommendation is The Automated Finance Plan: How to Automate Your Money Management, Feel Confident in Your Plan, and Finally Take Control of Your Finances written by Dave Stevens. Stevens promises that you can take control of your money now by following his step-by-step process that sets up a personalized Automatic Financial Plan. The best part? You won’t have to budget, pinch pennies, or spend hours each month tracking expenses and financial statements. It’s available right now on Kindle for $2.99, which is less than most cups of coffee.

Speaking of the cost of daily coffee consumption, in my next article, I will interview a very smart woman about an ingenious life-hack that allowed her to automate her way to an extra 2000 dollars just in time for the holidays by following a few simple financial automation techniques.

So, stay tuned and Happy Saving!!

Making Room For Faith

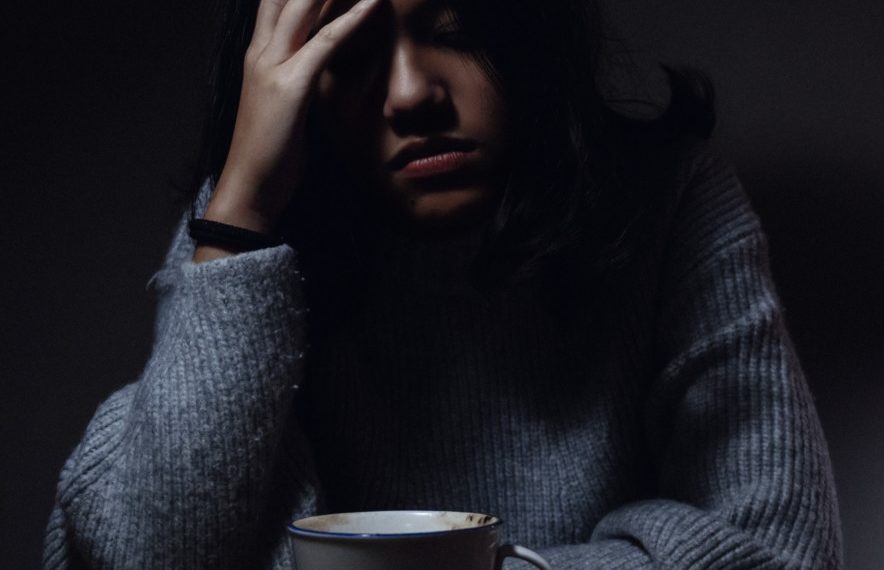

Very recently, I hit a wall. Not a literal wall, but rather the kind of wall that made me not want to get out of bed and deal with all of the things going on in my life at the time. It was tough realizing that I felt that way. And I felt even worse when I realized I had no idea how to stop feeling that way.

So, I turned to the one thing that always, always, ALWAYS helps me deal with difficult feelings and circumstances – my faith. Which is why I am so happy to share the following piece authored by AmPopsy contributor, Deidra George. A piece that helps all of us make room for faith and its close cousin, hope, in our lives.

I’m sure that all of us are struggling with something right now, whether that be job-related stress, anxiety around money matters, or just all of the feelings that come with the one-year anniversary of our Covid-imposed quarantine. I hope that Deidra’s words will offer you a bit of comfort, hope, and light with whatever stressors life is throwing your way right now.

Faith performs as a spiritual currency regardless of one’s religious beliefs. It allows you to respond to fear and worry from a place of power and peace, keeps you rooted in the land of hope, and gives you the ability to make wise, informed decisions even as you struggle with a difficult situation or troubling circumstances. As always, the toughest part in engaging in a faith journey is getting started. Here are a few tips to help you cultivate faith in the face of fear, worry, and anxiety.

Create Space for Faith. Establish a sacred space of peace. Share your thoughts of faith with a friend, spouse, or confidant. The power of agreement goes a long way. Surround yourself with people that genuinely support your vision. Write down affirmations, prayers or quotes that edify your belief and refer to them as needed.

Close the Door to Fear. Recognize the triggers that cause you fear and anxiety. Do not be afraid to remove yourself from toxic environments or people. Never compromise your core values and beliefs for opportunities. Speak positive words over your life and the people around you. Never lose hope.

Know That There Are Limitless Possibilities For You and Your Life. Expect great things to happen in your life. There’s nothing you cannot do once you decide to move forward. Allow faith to be your guide. Begin doing what genuinely makes you happy. Your authenticity is what makes you unique. Believe in yourself and trust the process.

Related…

Popsyisms…

“I refuse to let a system or a culture or a distorted view of reality tell me that I don’t matter. I know that only by owning who and what you are can you start to step into the fullness of life.” – Oprah

Your March Playlist

It’s International Women’s Month, and we are celebrating with our very own curated playlist full of upbeat, empowering, and confidence-boosting songs. This list is perfect for your next Peloton ride, morning run, or private dance party. It’s also great to listen to anytime you need a reminder that you are, indeed, a bad-ass chick.

The full playlist is available HERE for your Spotify downloading pleasure.

Happy Listening!

Celebrating Black History With “The Madness Collective” Creator, Crescent Muhammad…

As Black History Month draws to a close, AmPopsy had the chance to sit down with a few dynamic women who are making waves in their respective industries to discuss their thoughts and reflections on celebrating the rich history of African-Americans this month and every month.

In our final interview for this series, we speak with Crescent Muhammad, creator and host of “The Madness Collective”, a weekly online show featuring firecracker commentary from Crescent and her co-host, Antwane Cowen, on the major news and entertainment headlines of that week. Below, she speaks on the impact of growing up watching activism in action, finding hope through social media, and the new Black Renaissance.